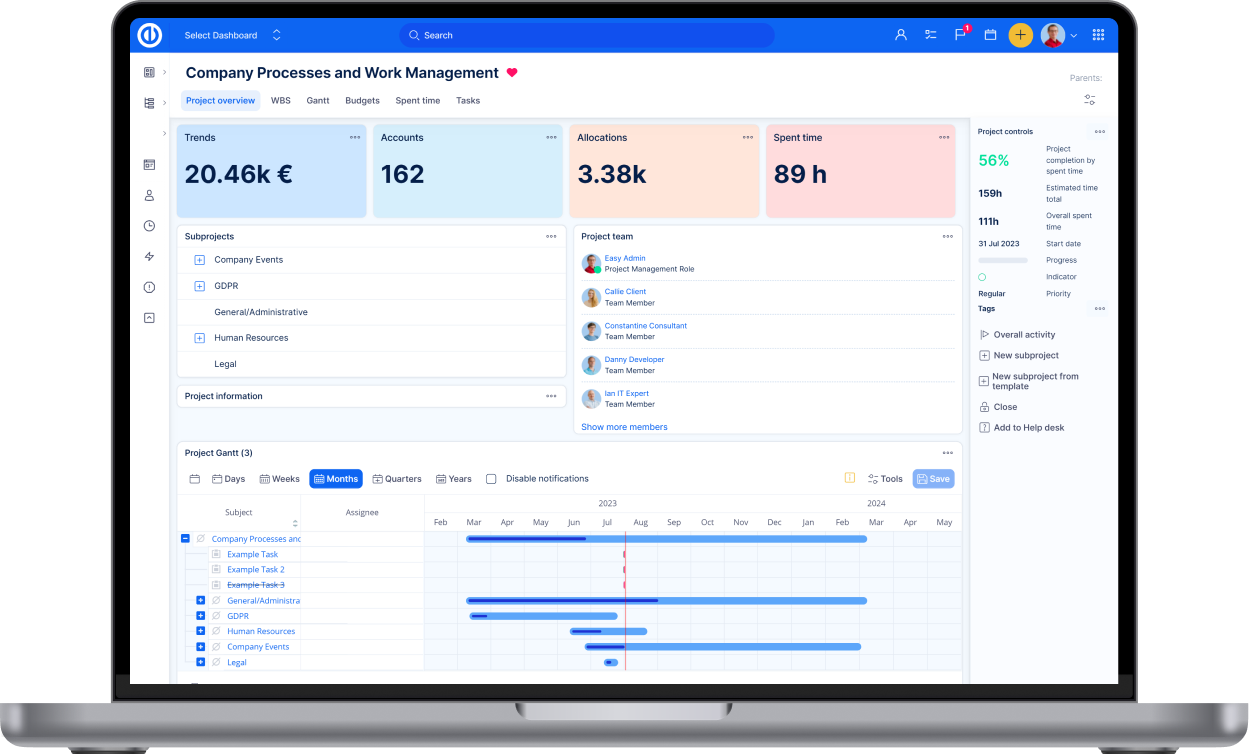

Items in project budget and overviews

Items in project budgets, portfolio overview and cash flow report have been renamed to better reflect their meaning. Here are explanations of all the items.

Starting with a view on budget of a single project.

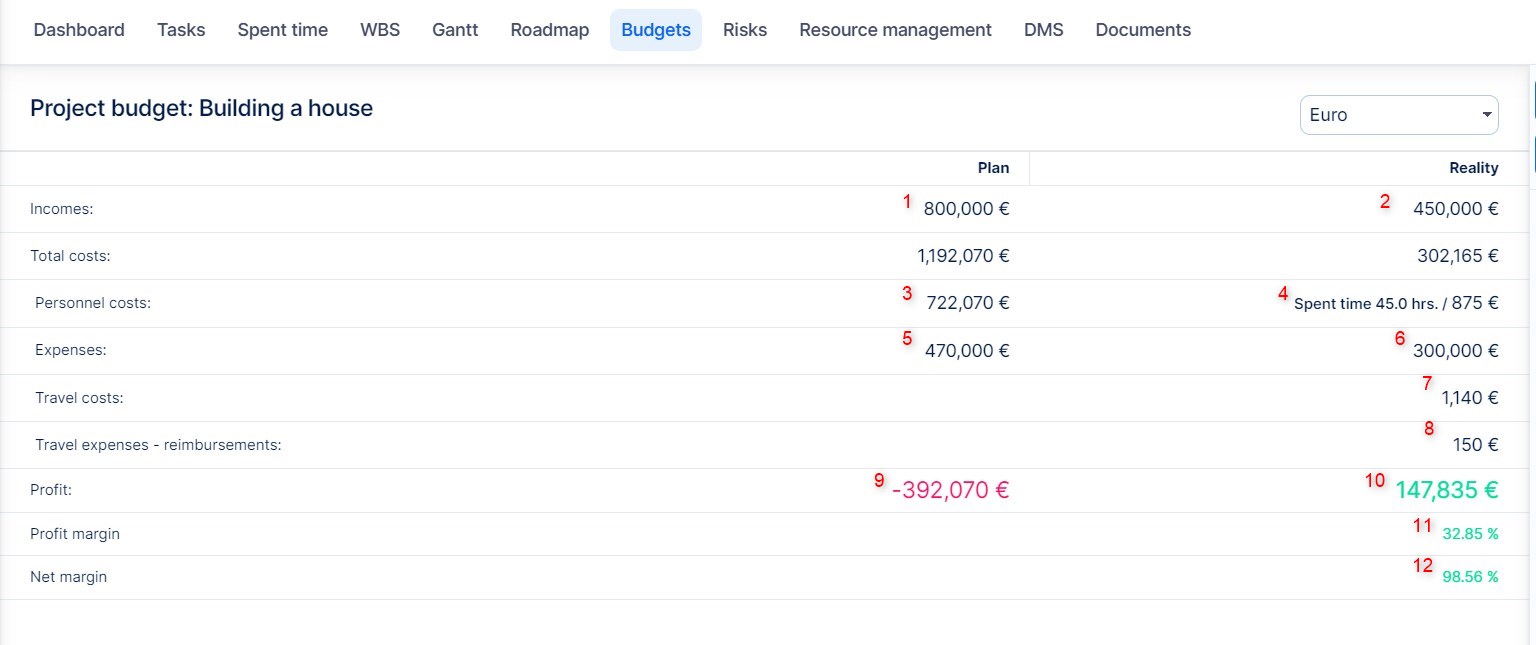

Incomes

1) Planned incomes - Incomes entered in the planned budget. Amount may be shown including or without VAT, according to the budget setting

2) Real incomes - Incomes entered into the real budget. Amount may be shown including or without VAT, according to the budget setting

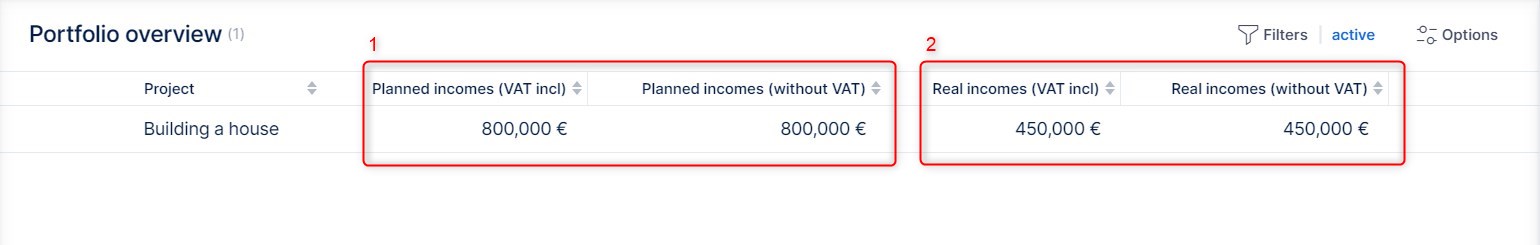

Incomes in portfolio overview

Costs

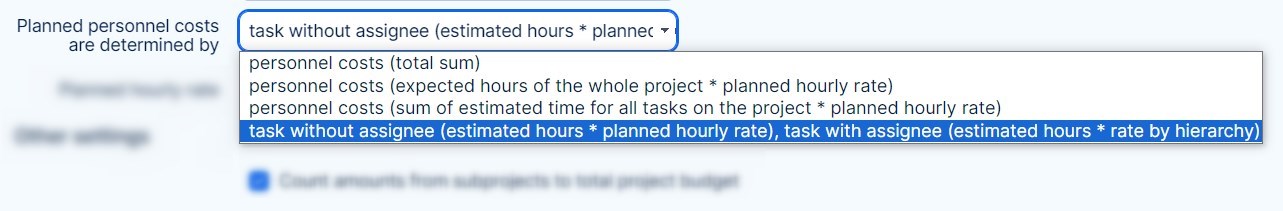

3) Planned personal costs - Planned personal costs can be entered in 4 different ways according to setting

- total sum - one given number, a rough estimate

- expected hours of the whole project * planned hourly rate - rough estimate of hours and an expected average rate

- sum of estimated time for all tasks ... - works with already created and estimated tasks on the project and an expected average rate

- tasks without assignee ... - the most precise, when you have agreed on most specifications with the client

4) Real personal costs - spent time * hourly rate. Cost rate settings are explained in detail in the related post. In project budget, this item is shown according to the budget setting

It is recommended to use internal rate here. External rate is mainly considered as the amount you are billing to the customer.

Personal costs in project overview

*) Average hourly rate - Total personal costs divided by spent time (hours) on the project

Planned hours - estimated hours when using the second option in planned personal costs

Expenses

Expenses can be understood as "other" costs. Amounts in this section may be shown including or without VAT, according to the budget setting

5) Planned expenses - project expenses entered into the planned budget (material, rent, services, etc.)

6) Real expenses - project expenses entere into the real budget (material, rent, services, etc.)

Expenses in portfolio overview

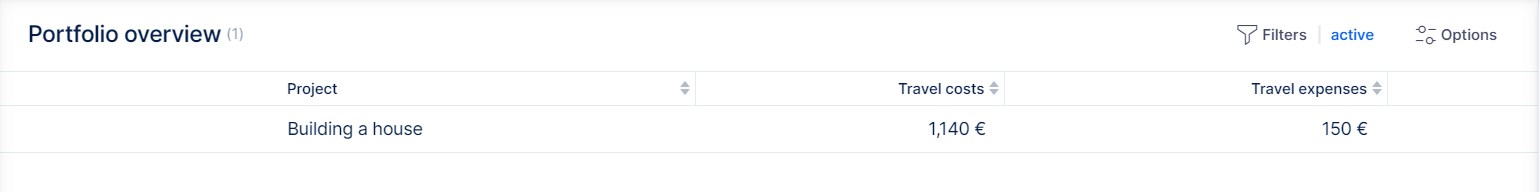

Travel costs and expenses

7) Travel costs - Distance * cost for unit (km, mi)

8) Travel expenses - reimbursements - number of days * cost per day

Travel items are not represented in planned budget. Rough estimates for travel items can be put into planned expenses.

Travel items in portfolio overview

Profits and margins

Planned and real profit are counted from amounts according to the budget settings

9) Planned profit = Planned incomes - Total planned costs

10) Real profit = Real incomes - Total costs

11) Profit margin = Profit / Incomes. It is the proportion of money left over from revenues after accounting for the cost of goods sold (COGS).

12) Net margin = Profit / (Incomes - Expenses). It is the percentage of net income generated from a company's revenue.

Total costs

Total planned costs are simply sum of planned personal costs and planned expenses.

Total costs (reality) are the sum of real personal costs, real expenses, travel costs and travel expenses.

In portfolio overview, you can view all combinations of expenses (with or without VAT) and personal costs (internal or external rate).

How is the Profit calculated

When changing currency on module “Budgets” on a project, the “Profit” value is the result of Incomes – Total costs (Personnel costs + Expenses). For example, let's say that you are using USD currency:

- Incomes ($)

- Total costs ($)

- Personnel costs ($)

- Expenses ($)

- Profit ($) = Incomes ($) - Total costs ($)

And when a user changes currency from “USD” to “EUR”, all the mentioned values change based on currency rate, apart from “Profit” since that is calculated from “Income – Total costs”, so the result would be as such:

- Incomes ($) → converted to Incomes (€)

- Total costs ($) → converted to Total costs (€)

- Personnel costs ($) → converted to Personnel costs (€)

- Expenses ($) → converted to Expenses (€)

- Profit in (€) = Incomes (€) - Total costs (€)

If a user adds Incomes/Expenses in €, it will be calculated in the same way. Every value is based on a specific exchange rate and each exchange rate is related to its date. Therefore, it is important to understand that the “Profit” value is calculated and not exchanged.